The 2-Minute Rule for Vancouver Tax Accounting Company

Wiki Article

Outsourced Cfo Services for Beginners

Table of ContentsThe Small Business Accounting Service In Vancouver PDFsTax Accountant In Vancouver, Bc Fundamentals ExplainedAll about Pivot Advantage Accounting And Advisory Inc. In VancouverUnknown Facts About Small Business Accounting Service In VancouverThe 20-Second Trick For Vancouver Tax Accounting CompanyFascination About Small Business Accounting Service In Vancouver

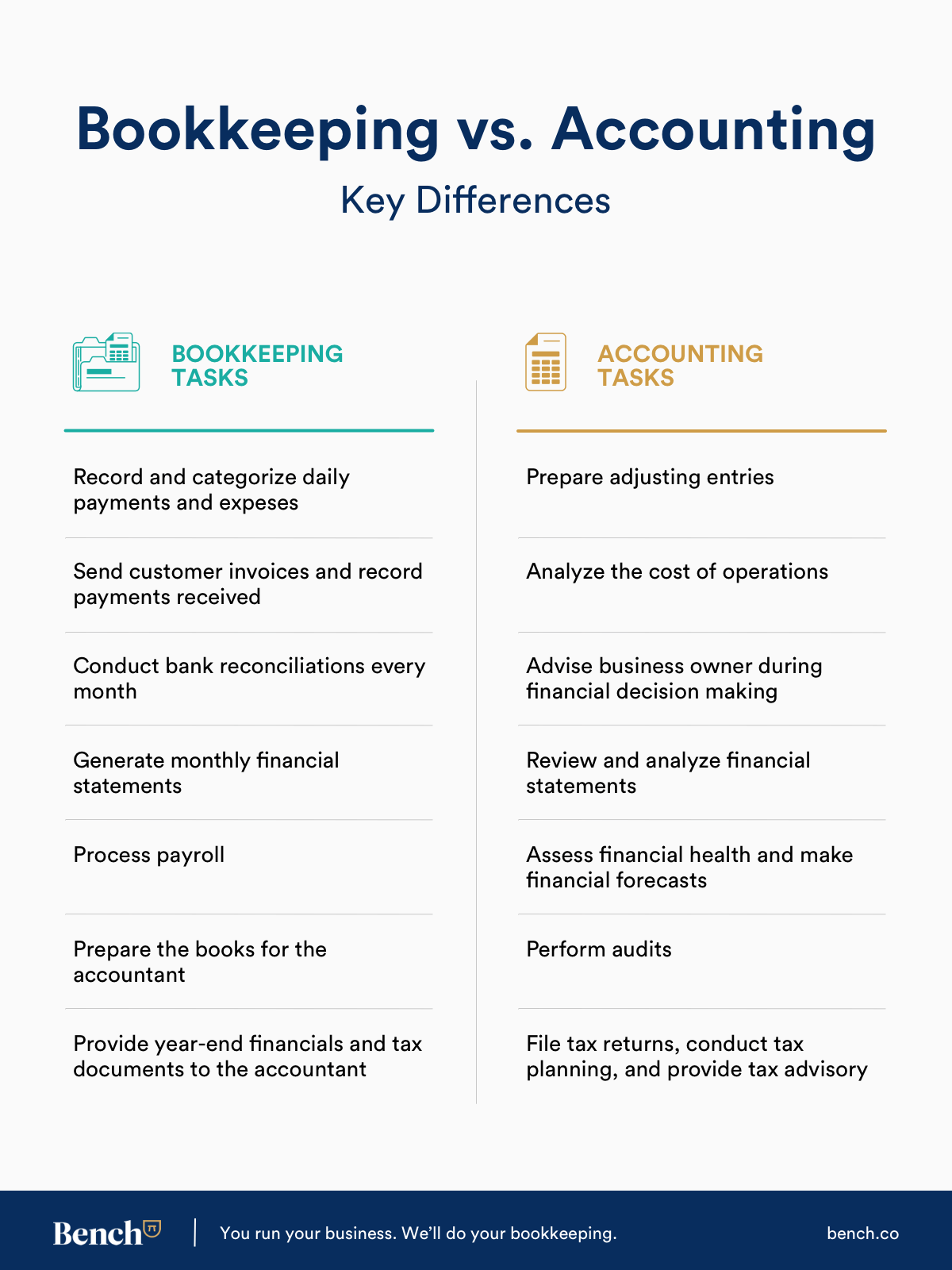

Here are some advantages to working with an accounting professional over a bookkeeper: An accountant can provide you a comprehensive view of your organization's monetary state, along with approaches as well as recommendations for making monetary choices. Bookkeepers are just liable for taping financial transactions. Accountants are needed to finish even more schooling, qualifications and work experience than accountants.

It can be tough to evaluate the appropriate time to hire an audit specialist or accountant or to determine if you require one in any way. While lots of small companies hire an accountant as a specialist, you have a number of options for taking care of monetary tasks. For example, some small organization owners do their own accounting on software application their accounting professional recommends or uses, offering it to the accountant on a regular, month-to-month or quarterly basis for action.

It might take some background research to locate an appropriate accountant since, unlike accountants, they are not required to hold a professional certification. A solid endorsement from a trusted coworker or years of experience are essential aspects when employing an accountant. Are you still uncertain if you require to work with someone to assist with your books? Here are three instances that show it's time to employ a monetary expert: If your tax obligations have actually become also complex to handle on your very own, with numerous income streams, international financial investments, numerous reductions or other factors to consider, it's time to work with an accountant.

The Only Guide to Small Business Accounting Service In Vancouver

For small companies, skilled cash monitoring is a critical facet of survival and also development, so it's wise to function with a monetary professional from the begin. If you favor to go it alone, think about beginning with audit software and maintaining your publications diligently as much as date. By doing this, must you need to work with an expert down the line, they will have visibility right into the full financial history of your service.

Some source meetings were performed for a previous version of this write-up.

Pivot Advantage Accounting And Advisory Inc. In Vancouver - Questions

When it comes to the ins and also outs of tax obligations, accountancy as well as money, nonetheless, it never ever injures to have a knowledgeable specialist to resort to for advice. A growing number of accountants are also caring for things such as money circulation forecasts, invoicing and human resources. Ultimately, a lot of them are taking on CFO-like roles.Small company owners can expect their accountants to assist with: Choosing business structure that's right for you is necessary. It affects exactly how much you pay in taxes, the documentation you need to submit and also your individual liability. If you're looking to transform to a Full Report different company framework, it might result in tax repercussions and also other issues.

Even business that coincide size and market pay extremely different amounts for accounting. Prior to we get involved in dollar numbers, allow's speak about the expenditures that go into small company accounting. Overhead expenses are costs that do not straight develop into a revenue. Though these prices do not exchange cash my sources money, they are essential for running your service.

Small Business Accounting Service In Vancouver Things To Know Before You Get This

The average price of accountancy services for small business varies for every one-of-a-kind scenario. Because accountants do less-involved tasks, their prices are typically less expensive than accountants. Your monetary solution fee depends upon the job you need to be done. The ordinary monthly accounting fees for a little service will certainly climb as you include a lot more solutions as well as the tasks obtain more challenging.For instance, you can tape deals as well as procedure payroll making use of online software application. You enter amounts right into the software, and the program computes total amounts for you. In some situations, payroll software program for accountants allows your accounting professional to use pay-roll processing for you at very little extra price. Software application remedies are available in all forms and dimensions.

4 Simple Techniques For Vancouver Tax Accounting Company

If you're a brand-new entrepreneur, don't neglect to aspect bookkeeping prices into your spending plan. If you're an expert owner, it could be time to re-evaluate bookkeeping prices. Administrative prices and also accountant charges aren't the only accountancy costs. outsourced CFO services. You need to also browse around this site consider the results accounting will certainly carry you and also your time.Your time is likewise important and also ought to be considered when looking at audit costs. The time invested on accountancy jobs does not create revenue.

This is not meant as legal suggestions; to find out more, please go here..

The Main Principles Of Tax Accountant In Vancouver, Bc

Report this wiki page